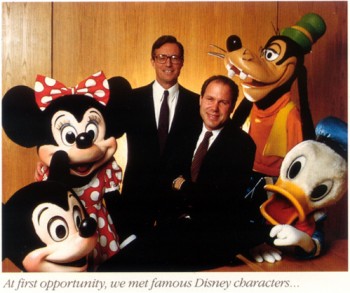

This inaugurates a new series of posts entitled “Oh, Eisner…”, in which I will reproduce for you every single annual letter to Disney company stockholders that former CEO Michael Eisner ever wrote. Why? I have no idea. Because I can?

Actually, these old annual report letters can be pretty entertaining. There are fleeting mentions of unrealized projects, unknowing and offhand mentions of future blockbusters, and the hubris-laden promotion of projects which turned out to be epic failures. And all of it comes in Eisner’s folksy (fauxy?), avuncular style which makes it sound like he’s sitting right there in your living room telling you all about his kids’ hockey games and summer jobs and how awesome Flubber is going to be.

Make no mistake – I ate this stuff up with a spoon when I was a kid. I got some Disney stock for Christmas one year (a total obsessive even then), and I think the first annual report I received was from the year 1988. Eisner was, by then, comfortably in the driver’s seat at Disney and his reports had become more chatty and familiar than the slightly numbers-focused letter reprinted below. Receiving the latest missive from “Uncle Mike” was a yearly high point for me, and somehow gave me a little something to look forward to in January to make up for Christmas being over.

Then, things got a little weird.

For Disney fans, there are probably few people for whom there are more conflicted feelings than Michael Eisner. For nearly a decade, he was uniformly praised as someone who had saved the company, arriving in 1984 on the heels of a massive reorganization caused by the near-dismantling of Walt Disney Productions by greenmailers and corporate sharks. Under his reign the parks blossomed and expanded, feature animation returned to success, and Disney became a relevant player in popular culture once more. They were back in the zeitgeist and on the television, with Eisner taking Walt’s place in the weekly introduction to The Wonderful World of Disney.

To be sure, Eisner exploited Disney’s properties in ways they had not been used in a long time. The brand had grown stagnant, and much of management was afraid of change. The only problem was that once Eisner started exploiting he never stopped. Like a lumberjack in an overgrown forest, he started swinging his axe but didn’t stop until all that was left was a vacant lot. The little kid who believed the tales of Eisner walking the parks picking up litter grew up to discover that the man had once actually tried to sell EPCOT, and later watched the parks slowly wither on the vine due to Eisner’s mismanagement. Not only that, but many of the positive changes attributed to Eisner’s early years had actually been set in motion under the auspices of previous company head Ron Miller.

But let’s go back to 1984 – the death of Frank Wells and Eisner’s decline were still years off, and there was nothing but a great, big beautiful tomorrow ahead for Disney fans. Change had come to Burbank, and a moribund Walt Disney Productions was springing to life once more…

To Our Owners and Fellow Disney Employees,

We would like to begin our first shareholder letter by expressing our great appreciation for having the opportunity to be part of Walt Disney Productions – the world’s best known and most respected family entertainment company.

We would like to begin our first shareholder letter by expressing our great appreciation for having the opportunity to be part of Walt Disney Productions – the world’s best known and most respected family entertainment company.

We joined Disney at the culmination of the most difficult period in the company’s 61-year history. During 1984 the corporation was affected dramatically by outside influences. The year was marked by both new business challenges and the arrival of a new management team.

On September 22, we joined 28,000 other dedicated employees who are eager to build and create value through excellence. As the newest “cast members” of Walt Disney Productions, we are both enthusiastic and respectful in becoming a part of a corporate culture that is unparalleled in American industry. As we approach our task of building Disney excellence around the world, we do so with a sense of pride and humility in following previous management successes in producing animated classic motion pictures, imaginative theme parks and entertainment magic.

As we have publicly stated, Ron Miller and Ray Watson, following several of the plans put in motion by the far-sighted team of Card Walker and Donn Tatum, clearly set the right track in positioning Disney’s resources and directions for significant growth and improved returns on investment.

Among their achievements were the establishment of Touchstone Films as Disney’s second motion picture identity, the acquisition of the Arvida Corporation – a premier community planning and development firm that will contribute enormously to improving the values of Disney’s significant land holdings – plans for a European Disneyland, and the creation of The Disney Channel, a concept that we believe is destined to become a leading revenue source in the years ahead.

We are also extremely grateful for the personal support and investment commitment of Fort Worth’s Bass family. By increasing their holdings in Disney common stock to approximately 25 percent of the outstanding shares, enthusiastically endorsing present management, and declaring their belief in the long-term investment value of the company, these investors have brought stability to the company and, at the same time, appreciate our full commitment to building maximum shareholder values.

Turning to the fiscal year ended on September 30, 1984, revenues increased 27 percent to $1.65 billion, marking the 17th consecutive year of Disney revenue growth. Net income increased five percent to $97.8 million, or $2.73 a share, compared to $93.2 million, or $2.70 per share a year ago. Significantly, operating income rose 32 percent to $291 million.

However, the company reported a loss of $64 million for the fourth quarter, reflecting certain unusual charges.

Before the unusual charges and an accounting change for investment tax credits recorded in the first quarter of fiscal 1984, net income for the year increased 16 percent to $107.8 million, or $3.01 per share as compared to $93.2 million, or $2.70 per share a year ago.

The unusual charges totaled approximately $166 million. The charges included a provision for write-downs of motion picture properties in release, production and development to their estimated net realizable values and the abandonment of certain conceptual theme park projects in preliminary design and development.

After thorough analysis and evaluation of the company’s various growth options, we have written down or abandoned those assets which we believe do not have continuing value in relation to newly defined corporate strategies and emerging business opportunities.

In addition, fiscal 1984 reporting reflects a change in accounting for investment tax credits from the deferral method to the flow-through method. This change resulted in the realization of $76 million in previously deferred tax credits as part of net income. This new accounting method brings the company into conformity with entertainment industry standards as it is practiced by all other major motion picture studios.

Contributing substantially to increased revenue flows in 1984 was the success of our first Touchstone Films’ production, “Splash,” (which established a Disney record of $69 million in box office revenues in initial domestic release and is presently performing strongly in overseas markets), the continued rapid growth of the home video market, and the excellent results produced by Arvida in our new Community Development segment.

The Disney Channel was also an important factor in improved revenues for the Filmed Entertainment segment. It gained about one million subscribers in the fiscal year, despite a difficult year for the pay cable industry at-large. We continue to estimate that the channel will become profitable by mid-to-late 1985, when the projected average number of subscribers is expected to reach two million. At the end of fiscal 1984, we had achieved over 1.4 million subscribers.

Revenues for the Entertainment and Recreation segment, which includes our domestic theme park operations as well as royalties from Tokyo Disneyland, also rose 6 percent to $1.09 billion.

Walt Disney World attendance, including the Magic Kingdom and Future World-World Showcase at EPCOT Center, totaled 21.1 million compared to 22.7 million in 1983. While exciting plans are underway to bolster 1985 attendance, last year’s figures were satisfactory. Attendance in 1984 suffers only by comparison with the prior year which was influenced by the extraordinary promotion and publicity associated with the opening of Future World-World Showcase.

In California, Disneyland attendance began at a rate exceeding expectations, primarily due to the theme park’s all-new Fantasyland attraction, but year-long revenues were ultimately impacted in the second half by the summer Olympics in Los Angeles. Despite a sharp decline in tourism, yearly attendance at Disneyland reached 9.8 million, compared to 9.9 million a year ago.

Overall, fiscal 1984 results from recurring operations were very positive, and we are optimistic that significantly higher performance levels can be achieved in the years immediately ahead.

Our job, essentially, is to accelerate Disney even further into the mainstream of American entertainment. We will do this by emphasizing creativity in every aspect of the company’s business. This challenge requires that we give great latitude, within pre-set financial boundaries, to the resources at hand while at the same time carefully managing Disney’s largely untapped treasure of assets – in particular our splendid film and television library.

We are shaping our management team, our management style, our organization and our resources with the aim of achieving high objectives in each separate business enterprise. We will be entrepreneurs, continuously looking at new markets, new opportunities and long-term growth potential for our unified business structure.

Our financial results make it clear that an imbalance is created by the fact that the Entertainment and Recreation segment is a disproportionately large source of income.

Therefore, the first objective in our new business plan calls for a dedicated effort to improve performance in every area. We intend to achieve a greater degree of balance between the various sectors in order to avoid substantial swings in income due to possible adverse effects on a single line of business.

Among our corporate goals is assuring the success of The Disney Channel, returning Disney to an industry leadership role in motion pictures and network television, expanding film distribution in both underutilized and untapped ancillary markets, accelerating land development, and extending our important Consumer Products business.

All of these objectives will be reviewed constantly while we continue to focus on methods of increasing theme park revenue. For example, new priorities are being given to aggressive, quality marketing and advertising support for Disneyland, which celebrates its 30th Anniversary throughout 1985, and we have already planned a series of exciting new attractions at Disneyland and Walt Disney World.

Last October, the finely-crafted Morocco pavilion opened at World Showcase and we are on schedule with Future World’s “The Living Seas” pavilion to be presented by United Technologies, scheduled for opening in early 1986. In addition, new types of theme park rides and attractions with special appeal for younger guests are soon to move from drawing board to reality.

Increased motion picture production is an urgent priority, with the aim of achieving parity with other major Hollywood studios and improving fundamental earnings in filmed entertainment. Our goals are to release 10 to 15 live-action features annually within three years. These offerings will be consistent with the high standards of quality and good taste for which the Disney name is known and valued around the world.

To lead Disney into the mainstream of contemporary film-making and television, we are fortunate to have attracted one of the most respected motion picture executives in our industry, Jeffrey Katzenberg. He comes to us as the highly successful former president of the motion picture production division of Paramount Pictures.

Jeffrey has been named President of our Motion Picture and Television division with responsibility for all production, marketing and distribution of theatrical motion pictures and television programs. He brings to our organization extensive entertainment industry experience and relationships. In addition, he is legendary for his remarkable capacity for tireless hard work.

The great legacy of Disney animation will be given renewed emphasis. We have a wealth of superb, experienced talent, a totally unique, creative force. “The Black Cauldron,” scheduled for its premiere at Radio City Music Hall in New York next summer, is the most ambitious and far-reaching animation project since the making of “Fantasia.”

In our former positions, we frequently envied the company that had already “built the product” and “needed only” to market it effectively. In Disney, we inherited that wonderful circumstance, with the incredible Disney film and television library.

The library is extensive and diverse and we believe substantial income can be realized from it over the next decade without damaging its future.

Carefully and sensitively managed, selective offerings to network television, syndication, the explosive video cassette market and pay cable services present extraordinary opportunities for revenue growth.

We are convinced that a plan can be orchestrated that will allow expansion in the ancillary markets without competing directly with The Disney Channel or inhibiting theatrical reissue of our classics. In fact, we believe that such an approach can actually increase public appetite for Disney products and increase the demand for the pay service.

In community development, Arvida is a well positioned new resource with excellent growth potential.

The assets Arvida brings to Disney include more than 20,000 acres of prime landholdings near major urban areas, a proven management team and a successful formula for developing high-quality, planned communities.

In order to capitalize on the acquisition, we have formed the Arvida/Disney organization to oversee all of our Community Development activities. It is composed of senior executives from both of our companies, led by Charles E. Cobb, Jr.

Arvida/Disney personnel are already working intensively together, shaping new and venturesome plans. Their priorities are to accelerate the development of Arvida’s existing communities, prepare a new master plan for Walt Disney World properties, expand our real estate financial services, and assist the company in such matters as determining the best site location for a Euro-Disneyland.

The Consumer Products segment, which has consistently enlarged character and product merchandising business through the years, will play an even broader entrepreneurial role in the future through its association with a Saturday morning cartoon series and the development of new character merchandising “stars.”

In addition, a new, full line of designer Disney sportswear for women was created by J.G. Hook and is being offered in 2,000 stores throughout the country. The line of women’s clothing and accessories will bear the “Mickey and Co.” label. Character merchandising also has licensed 85 products in support of 1985 motion picture offerings and their appealing new characters.

The Company remains financially strong, despite the turmoil of the past year and increased borrowings. As part of our overall financing strategy, we are restructuring our long-term debt to minimize interest costs.

We recently completed a $150 million Eurobond offering at an attractive rate which enabled us to retire higher-interest debt. We continue to be flexible in our ability to react to changing financial conditions.

As we set our direction, a very succinct explanation of our management philosophy is simply this: We intend to address ourselves daily, in all of our businesses, to achieving maximum long-term shareholder values.

At the same time, our efforts in shaping change and new directions will be made with the understanding that Disney is an institution. We do not intend to depart from its uniqueness. It is a heritage to be constantly nurtured and protected. We owe nothing less to our stockholders, our employees and to future generations of audiences.

We clearly recognize the legacy of a true creative genius of the twentieth century, Walt Disney.

We also acknowledge that we cannot rely on the Disney name and reputation alone to satisfy all the entertainment tastes of a new generation. Our objectives are to not only manage and aggressively market existing values and ideas, but to take our company to a leading position in today’s entertainment industry.

That is our commitment and the certain path to assuring the best possible return on investment for Disney shareholders.

Michael D. Eisner – Chairman and Chief Executive Officer

Frank G. Wells – President and Chief Operating Officer

So there you go – that was the year that was, 1984. The revenue numbers seem almost quaint in a modern context. To his credit, Eisner was right about a lot of things. Disney’s film and television library was underutilized, and there was a dearth of new content to keep the Disney name fresh. The imbalance in revenue between the parks division and the film studio was sizable, and had the potential to cause the company future problems. The Consumer Products division was indeed languishing due to the lack of unsuccessful new product to promote, and the inability to properly exploit existing properties.

A great deal of Eisner’s success came from making these undeveloped assets available to the public, and a great deal of his later downfall came from his inability to recognize that this initial skyrocketing rate of revenue growth could not possibly be sustained in the long-term without hurting the quality of Disney’s product. It’s also ironic that he championed the release of the studio’s back catalogue of films to television and home video, which some of former management had been reticent to do. A similar process would much later play out to Eisner’s detriment, when his own fear of new media led to his stubborn refusal to embrace DVD and digital distribution.

The ballyhoo about the Arvida deal is also amusing, as it would soon be unceremoniously dumped by the company. The purchase of Arvida took place during 1984’s struggle for control of the company, and it was assumed that management at the time had only purchased Arvida to increase Disney’s debt load and make the company less attractive to potential corporate raiders.

I also think it’s amusing how he keeps referring to EPCOT as “Future World-World Showcase.” Wha?

Another thing that can be seen is how much future success had been sewn by the previous management team. Touchstone Pictures and The Disney Channel got their start under Ron Miller, but much of their later success would be credited to Eisner. There’s even talk of the “European Disneyland,” looking for a future home even then.

Things I’m curious about: What was the write-down for “certain conceptual theme park projects in preliminary design and development” about? The abandoned World Showcase expansions? Discovery Bay? I honestly have no idea. I also wonder what he meant with the “new types of theme park rides and attractions with special appeal for younger guests.” These days, that’s pretty much de rigueur as Disney markets more to only children rather than the children within, but I’m not sure what Eisner was considering at the time. Probably something involving a Ferris Wheel.

So that’s 1984 – lots of chipper optimism and lip service for the company’s traditional values while alluding to expansion in new markets with new types of content. And, unlike reports in previous years which focused more on the parks and resorts, there’s an emphasis on the expansion of film production and distribution. This, after all, was Eisner’s previous area of expertise and interest and he was far more concerned with expanding the studio’s output and targeting an older movie-going audience than he was in dallying in theme parks. Would it all work out? We’ll see what happens in 1985…

[…] last we met, a fresh-faced and ambitious young Michael Eisner and his laconic sidekick Frank Wells had rocketed […]

[…] young Michael Eisner and his boon companion Frank Wells took over control of Walt Disney Productions, which was struggling to make its way in the modern film […]